What entity type is best for my startup?

Building a successful company comes with a unique set of challenges and responsibilities. One of the most critical aspects of managing finances effectively is staying accountable to your budget.

Although some might see a budget as an outdated restriction, it can be a powerful tool for working toward your long-term goals.

In this blog post, we'll dive into how you can use income statement reporting as a lever for long-term sustainability.

What is Budget Income Statement Reporting?

Budget income statement reporting is a financial document that shows how much money your business has brought in, how much you've spent, and what your profits or losses are.

It should include all of your revenue streams and expenses. A robust budget income statement can give you a good sense of how your business is doing financially and whether you're on track to meet your objectives.

It's an essential tool for managing your business's financial health.

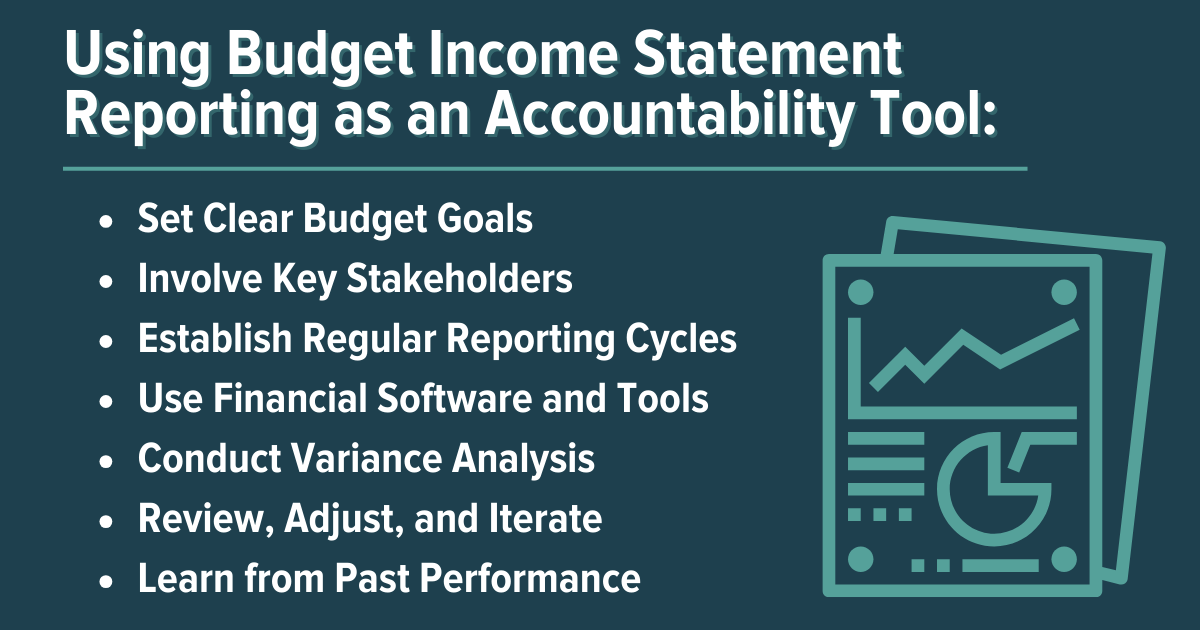

Using Budget Income Statement Reporting as an Accountability Tool

Have you ever wondered if your organization is staying on course financially? Budget income statement reporting provides a monthly snapshot of how your organization is doing and keeps you informed about your organization's overall performance.

Read on to see how you can benefit from this robust reporting tool.

Set Clear Budget Goals

Measuring your business's progress is nearly impossible without clear objectives. And, of course, well-defined goals are essential.

But what does that actually mean?

It means taking the time to sit down and figure out precisely what you want your business to achieve and building your budget around that. Do you want to earn more revenue? Manage expenses better? Maximize your profitability?

Clear, specific, and measurable targets build a foundation of accountability in your organization.

Involve Key Stakeholders

Everyone on your team will impact the company's results. Involving key stakeholders is a surefire way to make the process smoother and more successful.

Bringing in department heads, finance teams, and other decision-makers ensures that everyone understands their role in achieving the budget goals. Not only does this create a sense of ownership and accountability, but it also fosters collaboration and encourages diverse perspectives.

Establish Regular Reporting Cycles

Consistent reporting is a central aspect of budget management. That's why it's important to establish regular cycles for budget reporting. Whether monthly, quarterly, or annually, having a set schedule for budget reporting allows for timely analysis and adjustments.

Further, sticking to these reporting cycles adds an extra layer of accountability, ensuring that we stay on top of our financial goals.

Use Financial Software and Tools

Managing finances for a growing business can often feel overwhelming. Fortunately, modern financial software and tools have made tracking and reporting your budget more accessible than ever.

By leveraging these automated systems, you can automatically generate income statements that provide accurate and up-to-date information on your financial performance. This makes it easier to monitor and compare your spending habits against your budgeted figures.

Conduct Variance Analysis

Variances between actual financial results and budgeted figures can indicate anomalies in the market, poor assumptions, or a signal that something needs to change. Whichever the case, variance analysis is crucial to keeping your business on track.

Regularly comparing your financial results to your budgeted figures will help you spot discrepancies and determine the root causes. This will help you take corrective actions quickly and avoid serious issues.

Review, Adjust, and Iterate

The budget is typically set in stone in publicly traded companies. But in your own business, adjusting the budget as needed is OK if circumstances have changed.

A flexible budgeting approach allows for adapting to changing market conditions, promising business developments, and unforeseen changes. With this approach, you can be confident that your budget will always work for you, no matter what the future holds.

Learn from Past Performance

Looking back on the past can be an enlightening experience. Analyzing historical performance data can provide valuable insights and help you identify patterns, trends, and areas for improvement.

These benefits contribute to a more accurate and accountable budgeting process. that can inform future budgets.

Turn to an Expert for Guidance on Budget Income Statement Reporting

Budget income statement reporting is a crucial part of any successful business strategy. It helps track and monitor financial performance and serves as a valuable tool for accountability and goal-setting.

By following the advice outlined in this article, including aligning with key stakeholders to set clear budget goals, establishing regular reporting cycles, using financial software and tools to perform variance analysis, and learning from past performance, you can ensure your business stays on track financially.

However, handling all that yourself can be overwhelming and time-consuming. Turning to experts like Founder's for guidance on budget income statement reporting helps you ensure you're staying accountable to the goals you set. So why wait? Contact our experts today to see how we can help take your finance game to the next level!

Jan 18, 2024 1:19:40 PM

.jpg?width=500&height=500&name=Untitled%20design%20(1).jpg)