Are you comfortable with your SaaS chart of accounts? Or could it use some improvement?

A more organized system for tracking the money coming in and going out can significantly help the path toward financial transparency. Establishing a SaaS chart of accounts is a relatively easy problem to solve. It helps to set it up correctly the first time.

A well-thought-out SaaS chart of accounts helps you keep track of your revenue streams, expenses, assets, and more — ultimately leading to better financial success through greater visibility into your company's financial position. Read on to learn more about how to set up your SaaS chart of accounts!

Importance of a SaaS Chart of Accounts

A SaaS chart of accounts creates the core of any software-as-a-service company's financial reporting. It's a structured list of all the accounts and categories a business uses to record its financial transactions.

Your financial accounts track payments, expenses, revenue, and much more. A well-crafted SaaS chart of accounts provides a clear and reliable view of your startup's finances.

Simply put, a SaaS chart of accounts keeps businesses organized and on track, making it an essential tool for a successful organization.

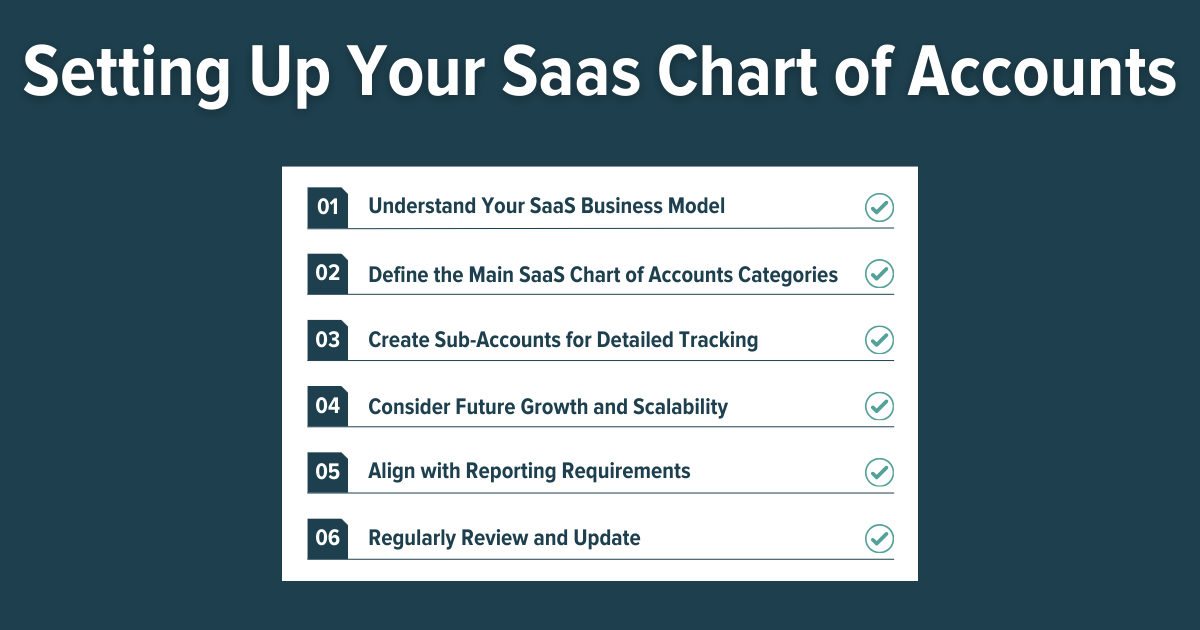

6-Step Guide for Creating a SaaS Chart of Accounts

One central aspect of an effective SaaS financial organization is your chart of accounts. But what exactly is a chart of accounts, and how can you create one for your SaaS business?

This 6-step guide walks you through the process from start to finish. You'll be able to create a chart of accounts that keeps your finances organized and helps you make data-driven decisions for your business.

Understand Your SaaS Business Model

It's not your chart of accounts that should steer the financial side of your SaaS company but your business that should take the lead. This means identifying and understanding your revenue streams, cost centers, and unique financial aspects of your business.

For example, subscription-based revenue is typical for SaaS businesses. Still, customer acquisition costs can have a massive impact on your bottom line. Like revenue, recurring expenses play a significant role when budgeting and planning for the future of your business.

Understanding your business's unique financial factors will better equip you to make strategic decisions about your chart of accounts.

Define the Main SaaS Chart of Accounts Categories

The chart of accounts is a breakdown of all the different financial categories in your business.

There are four primary categories: revenue, cost of goods sold (COGS), operating expenses, and assets and liabilities.

Revenue refers to the money your business makes from selling your product or service.

COGS includes the direct costs of producing and delivering your product or service.

Operating expenses are everything else in your business, such as salaries, rent, and marketing costs.

Assets and liabilities are the things your business owns, such as equipment, inventory, debts, and other financial obligations.

Familiarizing yourself with these categories equips you to establish a SaaS chart of accounts that matches your business structure and make informed decisions for the future of your SaaS business.

Create Sub-Accounts for Detailed Tracking

The major buckets are essential, but creating sub-accounts gives much more granularity in your revenue, COGS, and operating expenses.

This detailed understanding lets you follow the path money takes through your company.

For revenue, you can track monthly subscriptions and one-time license fees and upsell revenue separately to see which avenues bring in the most income. The COGS side shows spending on hosting, data storage, and third-party service fees. And when it comes to operating expenses, you can break down your marketing expenses, sales commissions, R and D costs, and admin expenses.

This level of detail helps you streamline your finances and make informed decisions for your business.

Consider Future Growth and Scalability

When creating your chart of accounts, consider your SaaS business's future growth and scalability. Will your chart of accounts readily accommodate new revenue streams, additional cost centers, and changes in your business operations?

A flexible chart of accounts can save you time and headaches in the long run as you won't have to adjust it to constantly keep up with your expanding business. When setting up your chart of accounts, some extra thought will ensure it can handle the growth – your future self will thank you!

Align with Reporting Requirements

As a business owner, keeping track of your financials is crucial. But it's not just about balancing your books. You also need to be able to generate reports that align with the reporting requirements of various stakeholders.

For example, internal teams need to see how the business is performing, while external investors want to know if their investments are paying off. And remember compliance - keeping track of your income statements, balance sheets, and cash flow statements helps you stay on the right side of financial regulations.

By ensuring you can readily generate these reports, you'll have a clear picture of your financial health and can make informed decisions about your business's future.

.jpg?width=500&height=500&name=Untitled%20design%20(1).jpg)